Having the best customer experience pays. But what is the value of having the best customer experience?

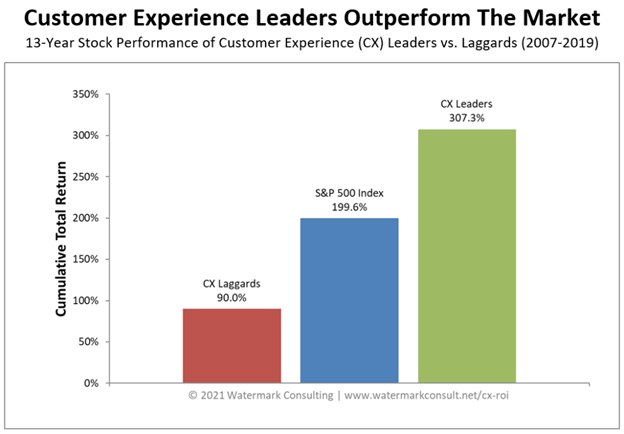

There’s plenty of data that shows that customer experience pays. The most compelling is Watermark Consulting’s tracking of stock prices. The company simulated purchasing the stock of CX Leaders (the ten top-performing companies in customer satisfaction on annual CX studies), Laggards (the bottom ten on customer satisfaction), and the S&P 500. Every year, Watermark “sold” last year’s Leaders and Laggards and “bought” the current year’s based on the new index results. Leaders outpaced the market, whereas Laggards returned less than half the value of the S&P 500.

Disclosure: This post is sponsored by RingCentral.

Stock price increases are the ultimate outcome of an improved customer experience, but you can’t prove it when looking at just one company (such as yours). And your CFO won’t believe it, anyway. But fear not! Other studies can help us and can also help show you how to do this analysis within your own customer experience. One such study comes from the XM Institute, which showed how the best customer experiences lead to increased revenue. Another study even showed that improving the customer experience actually decreased the future cost of sales.

To understand how certain companies create these great outcomes, my team and I conducted hundreds of interviews with CX leaders in companies large and small. We documented the results in my book, Do B2B Better: Drive Growth through Game-Changing Customer Experience. While the book targets business-to-business (B2B) programs, the lessons apply to any customer experience program.

We discovered that ¾ of programs are what we call “Hopefuls.” Members of these programs work hard, mapping journeys, identifying pain points, and telling the customer story. And they hope that their work reduces customer churn and costs to serve. But they can’t prove it. As a result, they cannot convince the organization to invest in customer experience sufficiently to see improved customer loyalty, defined by loyal customers who reward the company with higher customer lifetime value or reduced churn.

The remaining 1 in 4 programs (it’s actually 23%, but who’s counting?) actively link their work to financial outcomes. They show their business partners how an improved customer experience creates great financial outcomes, such as higher customer lifetime value and improved customer retention. Their “customer insights” aren’t restricted to surveys; they use more comprehensive methods to document the customer experience. I discovered that Change Makers engage in four activities that most programs don’t. Change Makers:

When you create a great customer experience, both your customers and your company benefit. Change Makers have built the infrastructure to prove the linkage, making it easier to earn investments in CX.

When this investment happens, our research across hundreds of companies shows that an engaged customer buys more, stays with your brand longer, and is more likely to engage in self-service and other behaviors that lower your cost to serve. It’s a CFO’s dream.

But for too many customers, the current customer experience is a nightmare. RingCentral’s research, conducted in partnership with Opinium Research, shows how experiences with customer service teams often fail to live up to their promise. Broken automation, repeated explanations of issues, and long wait times frustrate customers, preventing customers from being successful and companies from reaping the benefits of a superior customer experience.

In this blog post, I’ll discuss the emotional outcomes of a negative or positive customer experience and suggest how to improve those results, specifically with your customer support team.

When we studied the Change Makers, we discovered something surprising. Not only were they far more likely to measure the financial outcomes of customer experience (Action #1), but they also went beyond customer satisfaction to measure customers’ emotions created through their customer experience. This was true across multiple types of customer experiences. The Veterans Administration measured Trust. Compassion International (a large non-profit) studied happiness and delight. Hagerty also measured happiness in their policyholders. Dow even studies how enjoyable their customer experience is!

Once the companies learned the emotions created in their customer experience, they used this to specify an Emotional North Star – one emotion that best predicts higher customer lifetime value, lower customer churn, and reduced cost to serve. Next, they turned this positive emotion into a design target, a central component of their customer experience management program. By measuring and improving their Emotional North Star, they created an even more positive customer experience, leading to even better financial outcomes. I call this linkage the Customer Experience Loyalty Flywheel. By investing in customer experience and creating more positive emotional outcomes, customers buy more, stay longer, and interact in ways that are less expensive to serve, leading to improved business outcomes.

What emotions were these companies measuring? And what does this tell us about the customer service experience? Let’s look at three examples.

UKG, a large Software as a Service (SaaS) provider, was a continuing case study in Do B2B Better. The company measures eight emotions across the entire customer journey. They don’t publish the entire set of emotions, but two are confidence and customer frustration. Focusing on the positive side, they’ve found that confident customers are more likely to purchase additional products, less likely to churn, and are also more likely to use self-service tools such as UKG’s online community – a trifecta of great outcomes for the company and its customers.

And it’s not just UKG. Fidelity also measures eight emotions after interactions with a customer support team: Angry, Bored, Calm, Sad, Surprised, Happy, Excited, and Worried. It’s safe to assume they’ve connected these emotions to specific outcomes such as higher customer loyalty and reduced churn.

Both companies have seen the power of an emotional outcome in creating an exceptional customer service experience. So, they make a point to collect customer feedback to show them the specific emotions they’re creating in their journeys as the first step to improving their customer experience.

Hagerty is an automotive lifestyle company that provides auto insurance and other products to car enthusiasts – particularly classic car owners. They previously used traditional metrics to measure their customer journey until the day they switched their roadside assistance provider and discovered there was more to learn about their customer experience than they thought.

After changing their provider, their Net Promoter Score dropped significantly. This was surprising since the standard customer service KPIs didn’t show any problems. The calls were answered in the same amount of time, and the roadside assistance vehicles were showing up as promised, so nothing seemed to be any different.

To understand what changed, the customer experience team monitored phone calls between the drivers and the roadside assistance provider. And the light bulb went on when they understood that when the car owners called for help with this new provider, they felt an absence of empathy.

Of course, we all should feel empathy from our service providers when we need help, but for classic car drivers who are disappointed and frustrated that their trip was interrupted, this lack of empathy at the other end of their call was a big deal. While the functional service level—responding to a call and towing the vehicle—had not changed, the emotional experience was far worse. Hagerty learned that providing an empathetic emotional experience to drivers would restore previous customer satisfaction levels.

More importantly, it made the Hagerty team curious about what other emotions could be behind customer satisfaction and NPS scores. They went on to identify that “happiness” was the emotion that best predicted customer loyalty. The company’s CX team was able to draw a straight line through their customer experience.

The holy grail for any customer support team!

Consistently creating confidence, happiness, or other positive emotional experiences that lead to reduced customer churn and higher customer lifetime value is clearly the goal that we all need to inspire. But traditionally, it was nearly impossible to do this affordably. Companies invested in expensive software and hired dozens – or hundreds – of coaches to ensure their contact center personnel showed the empathy necessary to create happy customers.

But there’s good news! The rise of AI means that many of these capabilities are now within reach of brands without billion-dollar valuations. I spent some time with the RingCentral team to understand how they use AI to help their customers improve their customer experience management programs.

Improving the Service Experience

To examine how AI can help create positive customer experiences and strong emotional outcomes, let’s start by understanding the opposite—the common frustrations customers feel during poor customer experiences, particularly during a service call.

RingCentral’s research (referenced earlier) surveyed 6,000 customers to understand what created a poor customer experience. Three factors rose to the top:

“Our research revealed that companies can no longer afford to overlook how customer experiences impact their bottom lines and, ultimately, long-term success,” said John Finch, Vice President of CX Product Marketing at RingCentral. He added,

“Thoughtful AI-powered solutions, like RingCX, are essential to bridging the gap between agents and customers by streamlining workflows, reducing friction, and enhancing the overall experience to ensure customers feel valued at every touch point.”

It’s no wonder that – even before the pandemic – the CEB discovered that when customers reach out to your call center, they are 3.93 times more likely to become less loyal than they were to become more loyal customers.

Improve Automation

When you call a provider, do you immediately shout, “Get me a human”?

It doesn’t have to be this way. We’ve learned this behavior through poorly planned static branching programs that made it difficult to find the help you need. Traditional technology requires you to create one branching plan based on guesses of what customers want.

When struggling to solve a problem, patience is in short supply, so why wouldn’t customers opt to talk with a human first? AI solves this problem by analyzing past interactions and presenting the most relevant options first, enabling customers to get the right solution immediately. When you can solve your problem faster through self-service than talking with a live agent, it changes the equation, leading more customers to opt for the bots.

Reducing Hold Time

Improving the self-service customer experience also helps prevent the second frustration: waiting on hold for an agent. Since self-service is prioritized based on an individual customer’s needs, an agent may never be required. This helps the experience for those who truly need an agent. As more calls are satisfied through self-service, wait times are reduced for the rest.

Improving Customer Experiences with Live Agents

However, even the best system sometimes requires a live agent, and AI can also improve the outcomes of human interactions.

Intelligent routing helps match the customer to the best available agent based on the caller’s history and the list of products purchased by that individual. Matching the right caller to the right agent increases the likelihood of quick resolution.

But transfers happen even in the best system, and this is an area ripe for frustration. Traditionally, companies had to choose between a warm transfer (which is expensive) or requiring the receiving agent to ask customers to repeat their issues because the first agent didn’t have time to document the case. Neither created a great customer experience.

New AI tools greatly accelerate issue documentation. Not only does this save you the expense of long downtime while agents document case history, but it also enables a receiving agent to understand the call history quickly, accelerating resolution and preventing customers from having to re-explain their issues. The ability of the second agent to immediately move into problem-solving mode helps your customers feel more confident – one of those great financial outcomes.

Steve Rafferty, VP of International at RingCentral, comments, “The good news for businesses is the latest advances in generative AI can solve many of the challenges our research highlights by bringing together voice, video, and digital channels seamlessly so agents can easily engage with customers. From giving customers access to their channel of choice to ensuring agents have the full context of that person’s journey and interaction history, technology has a huge role to play and should be a cornerstone in any strategy to delivering industry-leading customer experience.”

For far too long, the customer service equation seemed like a zero-sum game: for customers to have a better experience, the company had to make huge investments. So, often, the customer lost because these investments were difficult to justify. AI is changing the math, enabling customer service to be a win-win outcome. By creating an improved service experience that builds confidence, customers spend more, stay with a brand longer, and move to less expensive ways of interacting. And that’s math that any Finance group can appreciate.